REGIONAL LABOUR MARKETS DECOUPLE FROM METRO

Labour market conditions around the country are very tight.

Over the extended COVID-19 period regional labour markets have decoupled from metro labour markets twice:

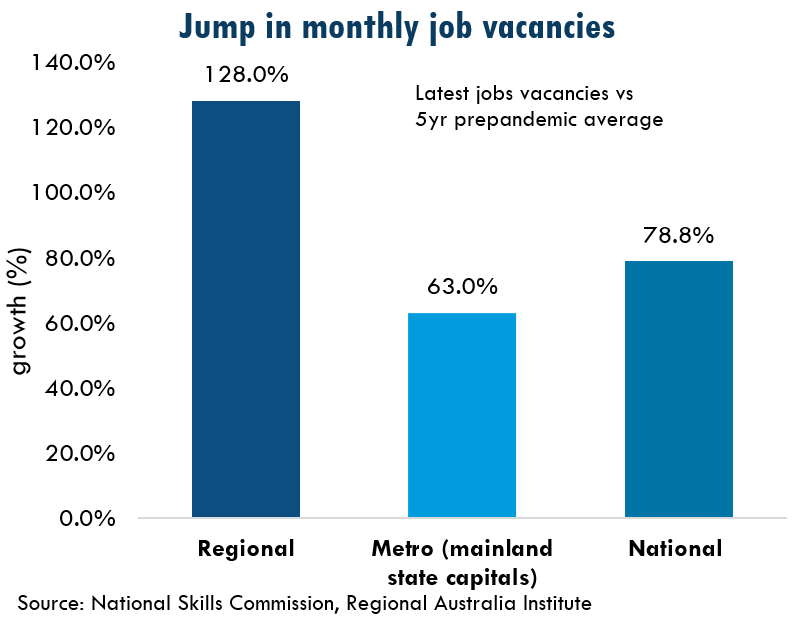

- Regional demand for labour jumped further and faster than metro markets from late 2020 to February 2022’s interest rate rises.

- Vacancy growth flattened abruptly in metro areas after Feb 2022 while regional vacancies have continued to climb.

Some historically significant milestones:

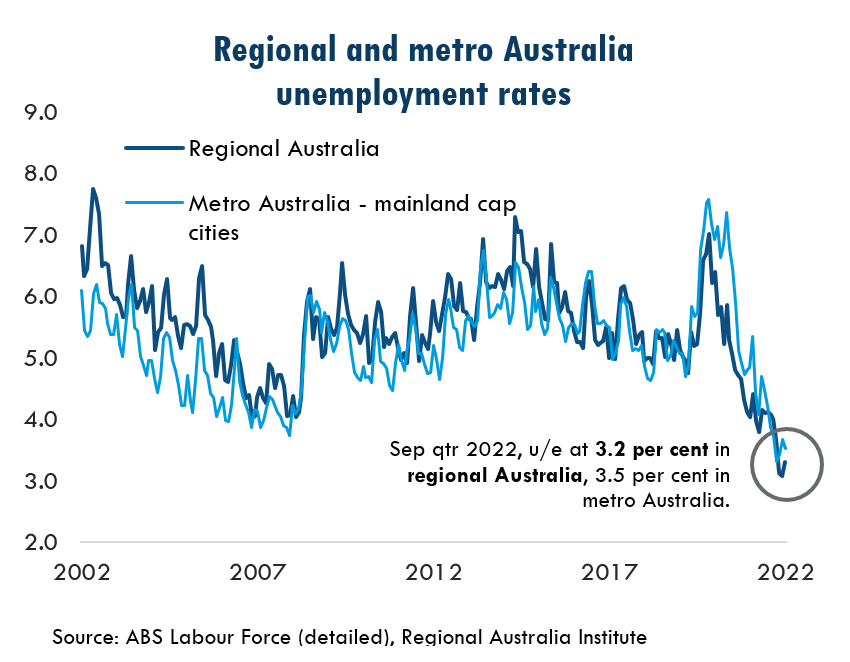

- Regional unemployment has been tracking lower than metro unemployment over the last two years. Historically, the reverse has been true.

- Regional unemployment continues to plumb new lows, averaging just 3.2 per cent in the September 2022 quarter – the lowest in more than 30 years.

- Regional demand for labour continues to break records. More than 94,000 vacancies were posted in October 2022, following September’s record of around 93,000 vacancies.

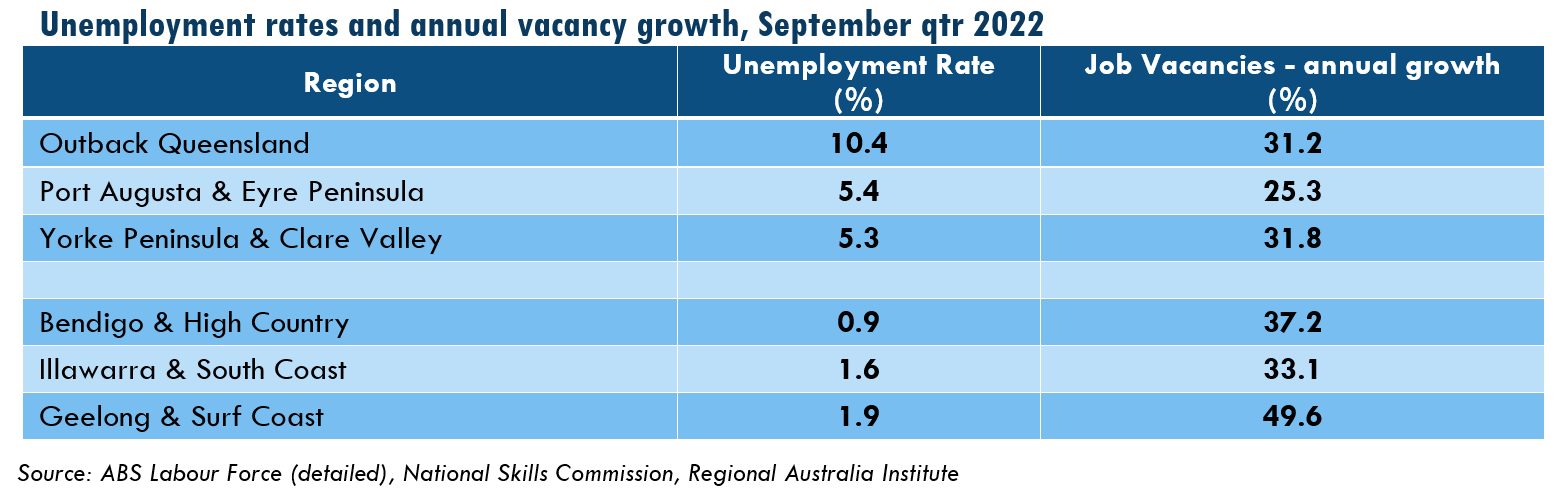

And while there is diversity underneath this aggregate regional unemployment rate, high demand for labour regionally is just about universal – see further below for a snapshot of the range of conditions across regions. This snapshot shows that even in regions where unemployment has been persistently high, demand (job vacancies) continues to grow significantly. In previous notes we’ve talked about the need for policy and program responses to be tailored accordingly.

WHY ARE REGIONAL ECONOMIES SO STRONG?

2 OUT OF THE 3 Ps ARE FIRING IN REGIONS

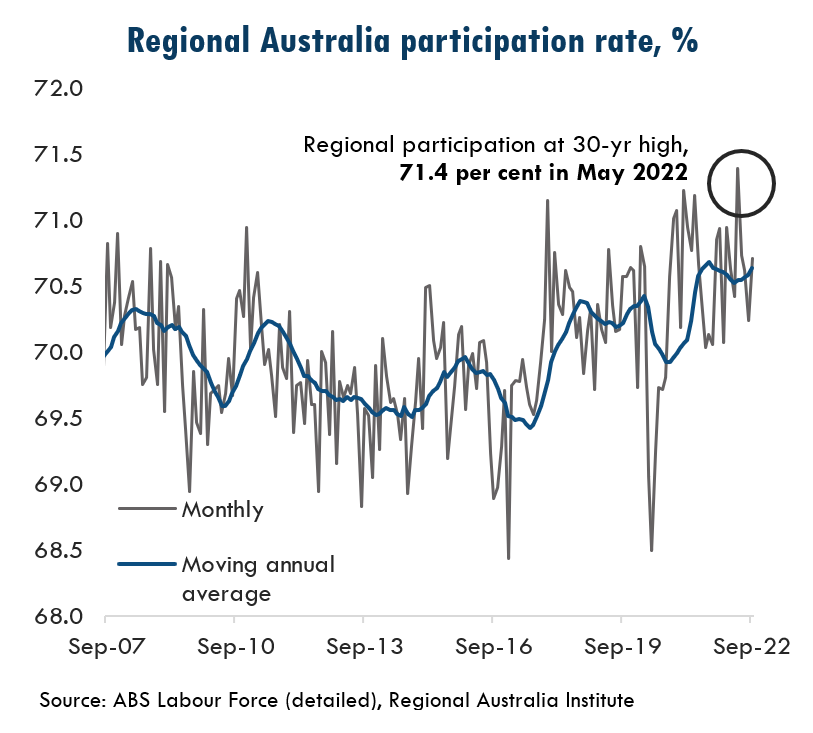

Regional Australia’s exceptionally tight labour market – and economic – conditions are underscored by strong economic fundamentals. Specifically, two out of the three Ps (population, participation and productivity) are firing.

In terms of participation, regional people are keen and engaged to work – the regional participation rate reached a 30-year high of 71.4 per cent in May 2022 and has remained broadly around this rate since then.

Meanwhile, regional populations continued to grow through the pandemic – a stark contrast to the situation in the capitals (Sydney and Melbourne in particular).

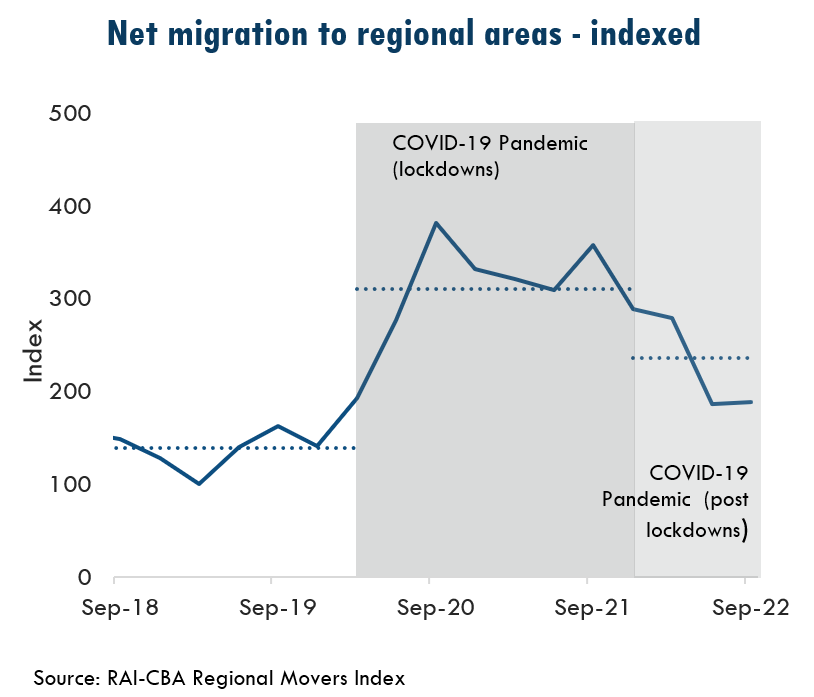

The Regional Movers Index tracks population flows from capitals to regions and includes a measure of net migration to regions.

At the height of the pandemic – when lockdowns were widespread and most severe in capitals – net migration to regions was double the levels that had prevailed in the two years pre-pandemic.

Since the ending of those severe lockdowns, regional people have resumed moving to capital cities. Nevertheless, those net migration flows to regions (from capitals) remains significantly larger than pre-pandemic – in the order of 70 per cent.

In contrast, ABS data shows that for the first time in more than 20 years, both Sydney’s and Melbourne’s populations shrank in the year to June 2021. These very different population dynamics are a key factor behind the relative outperformance of regional labour markets over their major metro counterparts, discussed in more detail below.

IF POPULATIONS ARE GROWING, WHY ARE REGIONS STILL STRUGGLING TO RECRUIT – AND POSTING EVER-INCREASING JOB ADS?

DEMAND FOR WORKERS IS STILL OUTSTRIPPING SUPPLY

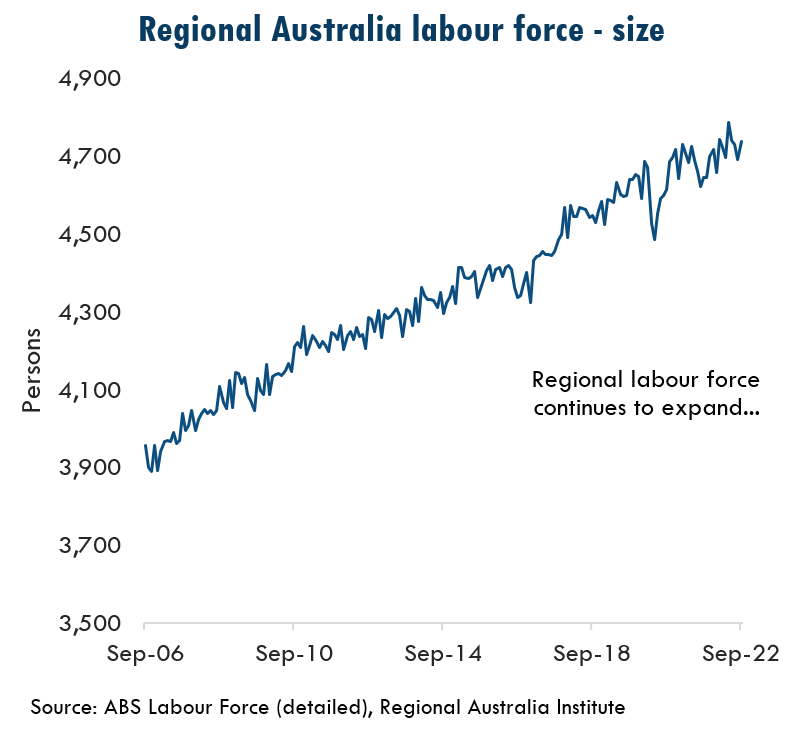

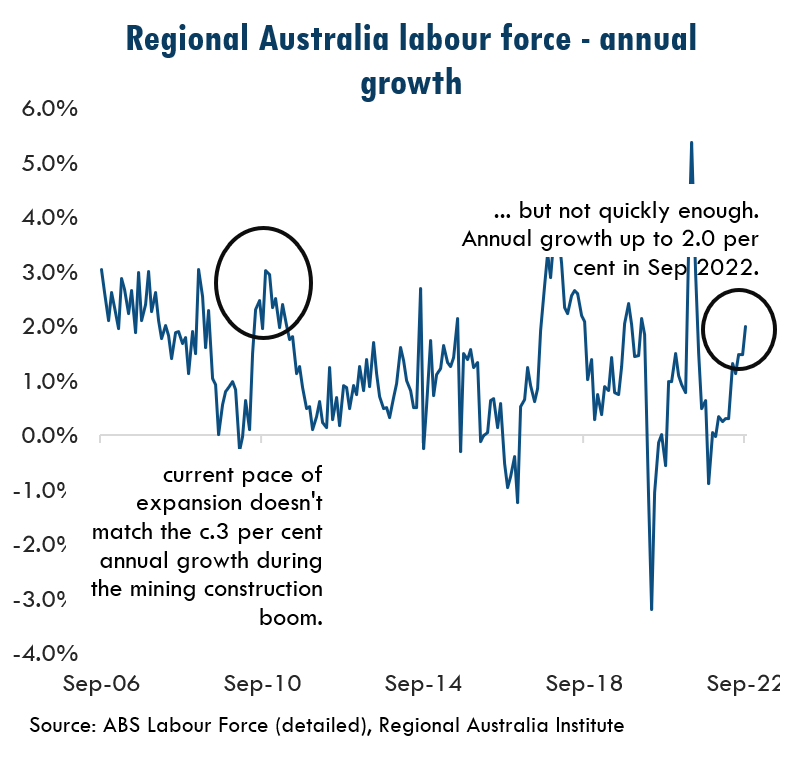

The charts opposite show that while the regional labour force is expanding, this is just not happening quickly enough.

Comparing the current environment with the mining construction boom period a decade ago is instructive.

Demand for labour during that mining construction boom period was high – vacancies reached a (then) peak of 59,100 jobs at the end of 2011. Meanwhile the regional labour force expanded very quickly in response – growing by around 3 per cent per annum around that time.

Today, vacancies are running at nearly 60 per cent more than those previous-peak vacancies associated with the mining construction boom. Yet the regional labour force has only managed to grow by 2 per cent over the year to September 2022.

The high demand for labour – record job ads – in regions is underscored by:

- High and enduring business confidence and conditions. Good economic conditions in regions have given businesses the confidence to invest in additional staff. Generally, the pandemic’s impact in regions hasn’t been as significant as in the capitals. For tourism and hospitality businesses in particular, the closed international border diverted holidaymakers to Australian regions. Meanwhile in the ag sector growing conditions were favourable through 2021 and 2022 – and these have coincided with high commodity prices. Current flooding in eastern Australia is undermining that good run. Conditions in regions are also likely to be less sensitive to interest rate hikes than in the capitals. The lower dwelling prices (and smaller mortgages) in regions are likely to be cushioning the effect of rate hikes compared with what’s experienced in the capitals – given that the housing sector (and mortgage market) is a key channel for the transmission of monetary policy into the wider economy.

- Regional population growth. The pandemic also created the impetus for many city dwellers to make a permanent shift to regions. With this additional population comes additional demand for goods and services locally and therefore the demand for additional workers to provide these. This is especially the case with many new arrivals bringing their city-based jobs with them rather than filling local jobs.

- Ongoing expansion of the services sector. Long-term, structural economic changes continue to favour the expansion of labour-intensive service industries like health, allied health, education, community services, aged care and childcare. This is not just a metro phenomenon, and is a significant driver of labour demand in regional Australia.

The constraints and dynamics on the supply side of the regional labour force include:

- Pool of workers ready and available to work has just about dried up. With unemployment so low and participation already very high, the availability of local people ready and able to work has just about dried up. Employers are being forced to advertise more widely. Part of the record vacancies being advertised reflect this with employers having to re-advertise or go through these internet-based channels compared with more informal channels preferred previously.

- High labour mobility. The record vacancies being advertised are also a mix of new and replacement jobs. With overall labour mobility currently quite high, employers need to backfill jobs left by people moving on – so employers are needing to backfill jobs more than usual.

- Closed international border. The closed international borders stopped the flow of migrants into regions – for both long-term and short-term settlement. While borders have re-opened the key sources of seasonal transient labour – backpackers and students – have not returned to pre-pandemic levels.

- Local skills mismatch. There is a significant skills mismatch in many regions – demand is greatest for high-skilled trades and professionals but supply of these in regions has fallen due to the erosion of regional post school learning opportunities (VET and tertiary) making it harder to get those qualifications in region.

- Gaps in key regional soft and hard infrastructure. Two key examples include housing and childcare. Suitable housing is in short supply in regions, putting a cap on the number of people who can move into the regions with high job vacancies. Childcare is also in short supply, restricting the ability of people with young children to take up work.

THE DETAILS: REGIONAL JOB VACANCIES, NATIONALLY AND AROUND THE GROUNDS

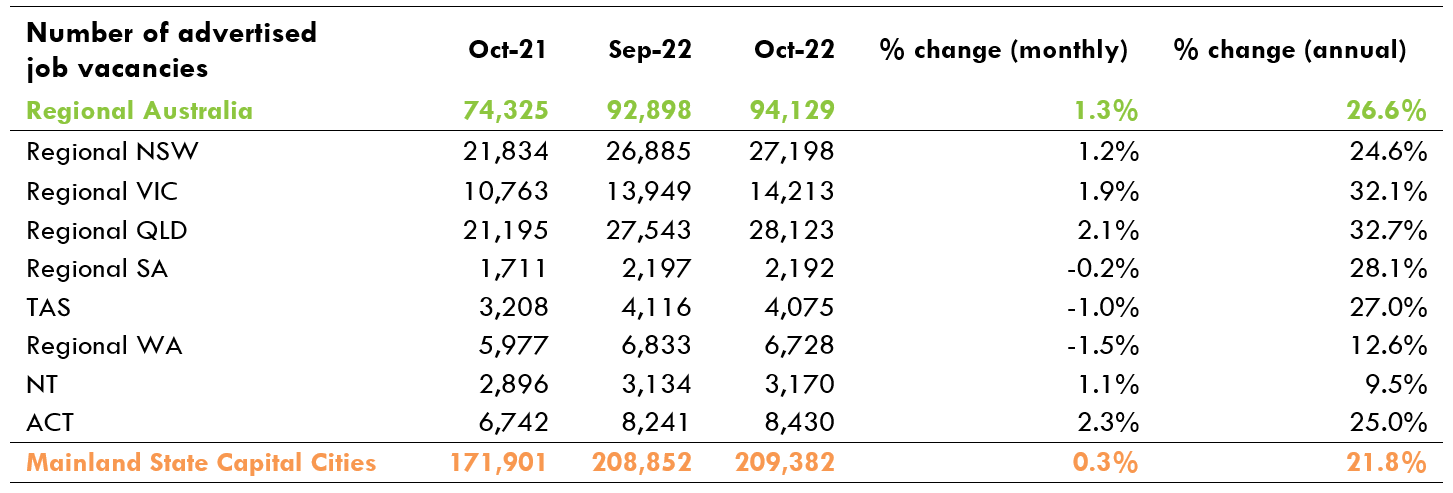

As we enter the final stages of 2022, demand for labour in regions hasn’t let up – a new record of some 94,100 regional jobs were advertised online in October.

This latest number of vacancies is 1.3 per cent more than in September, and 26.6 per cent higher than a year earlier. This profile of growth in regional Australia contrasts with the situation in metro Australia, where job ad growth started to flatten out at current levels in February 2022.

In the month of October, demand for labour was greatest in regional Queensland (some 28,100 ads) followed by regional New South Wales (27,200 ads) and regional Victoria (14,200 ads). Not only has regional Queensland (in aggregate) recorded the largest volume of ads, the Sunshine State has also seen the largest growth in job ads, in both monthly and annual terms (up by 2.1 per cent and 32.7 per cent, respectively).

The monthly increase in job ads wasn’t universal across the country. Some states’ regions (in aggregate) saw modest if not marginal declines during the month – regional WA (-1.5 per cent), Tasmania (-1.0 per cent) and regional SA (-0.2 per cent).

The annual growth in vacancies in the various regions is in the double digits, ranging from just less than 10 per cent to 40 per cent. The only region where there were fewer vacancies in October 2022 than in October 2021 is Dubbo and Western NSW (down by 16.0 per cent).

The five regions that recorded the largest monthly increases in vacancies in October 2022 are:

- Yorke Peninsula & Clare Valley in SA with 8.5 % more vacancies in October 2022 (365) than in August 2022 (336)

- Ballarat & Central Highlands in VIC up by 7.1% (1,455 compared to 1,359)

- Toowoomba & South West QLD up by 4.6% (2,882 compared to 2,756)

- Central QLD up by 3.6% (4,614 compared to 4,456)

- Wimmera & Western VIC up by 3.0% (1,301 compared to 1,263)

The five regions with the largest annual increases in vacancies between October 2021 and October 2022 are:

- Yorke Peninsula & Clare Valley in SA up by 43.0%

- Gosford & Central Coast in NSW up by 42.3%

- Geelong & Surf Coast in VIC up by 39.7%

- Central QLD up by 38.3%

- Blue Mountains, Bathurst & Central West NSW up by 36.8%

In terms of the occupations being demanded, the most vacancies are for Professional roles (25% of all vacancies in October), followed by Technicians and Trades roles (15%), Community and Personal Service roles (14%), and Clerical and Administrative roles (13%).

ADDITIONAL REGIONAL LABOUR MARKET INDICATORS:

SPREAD OF UNEMPLOYMENT RATES ACROSS REGIONS – LOWEST BELOW 1 PER CENT, HIGHEST REMAINING AROUND 10 PER CENT.

Meanwhile annual growth in job vacancies is universally well into the double digits.

ADDITIONAL REGIONAL LABOUR MARKET INDICATORS:

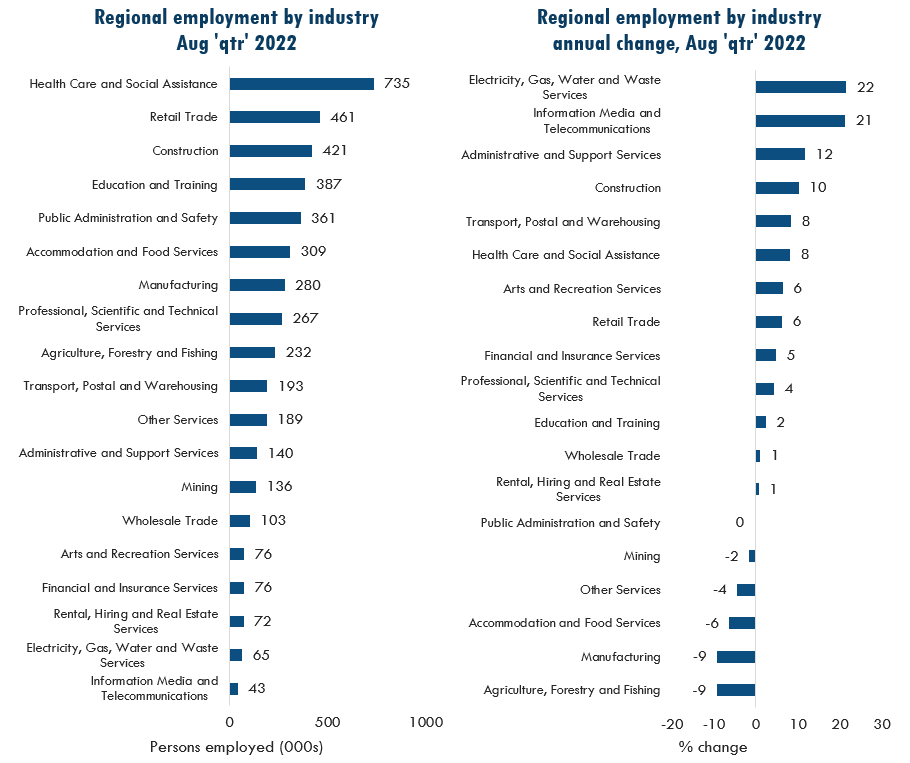

During the three months to August 2022, an average of some 4.5 million people were employed in the regions, up by 2.6 per cent on a year previously.

SOURCES The Internet Vacancy Index is updated monthly by the Department of Education Skills, Employment and Business (lmip.gov.au/default.aspx?LMIP/GainInsights/VacancyReport). The RAI has an interactive Regional Job Vacancy map of the data showing vacancies in 37 regions across Australia (regionalaustralia.org.au/home/regional-jobs-vacancy-map).