By Chief Economist, Dr Kim Houghton

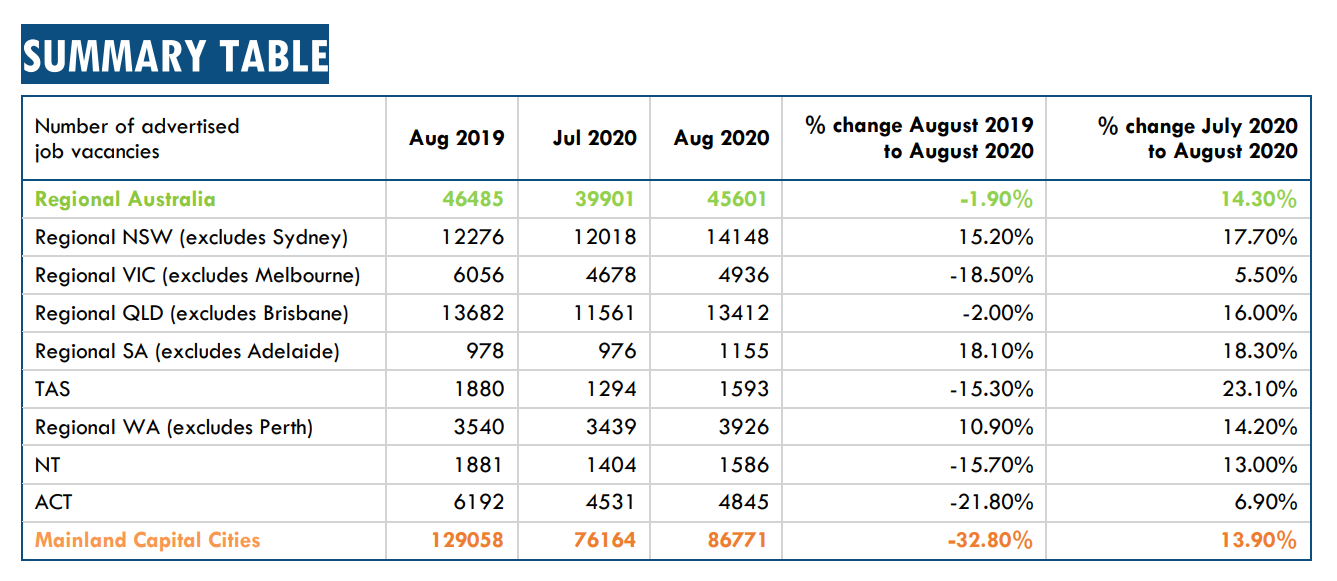

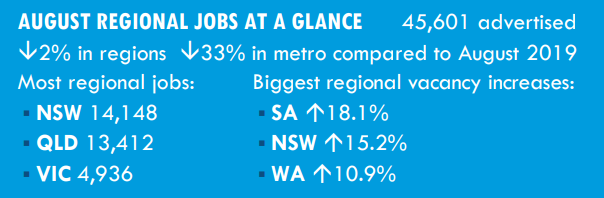

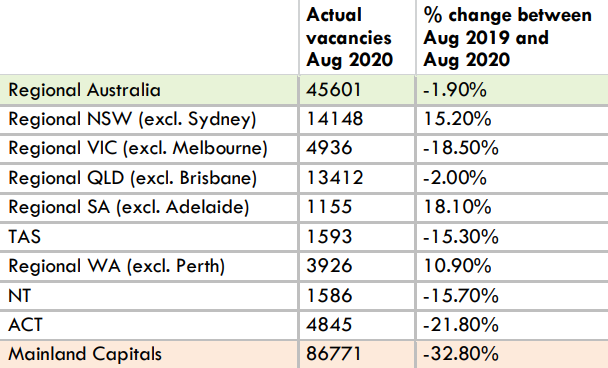

In August 2020 there were over 45,600 jobs in Regional Australia advertised on the internet – outside the mainland state capitals. August regional vacancies edged up from July, and in total were just 1.9% below levels a year ago in August 2019. Regional job vacancies have been rising gradually since the low point in April.

This internet vacancy series is a three-month average, so the figures soften the month to month volatility in employers taking the time to advertise vacancies.

The August data highlights the big differences between regions as they emerge from the COVID-19 restrictions. Many regions are now seeing more vacancies advertised in August 2020 than there were in August 2019. Standout vacancy growth is seen in Dubbo and Western NSW which had over 1,100 vacancies advertised in August 2020, up 50% on the 767 vacancies in August 2019. Other regions showing growth were Southern Highlands and Snowy (NSW) and Southwest WA, each with vacancies last month around one third higher than August 2019.

In August 2020 the jobs in most demand in Regional Australia continued to be well paid mid- to high-skilled professionals and trades jobs. These two occupations accounted for some 42% of all advertised vacancies. But looking at growth rates, lower skilled vacancies are leading. Vacancies for Labourers and Community & Personal Services workers are up over 10% on August 2019 levels in Regional Australia, while the higher skilled professions and trade vacancies were still 5% below their levels last year. Regional employers are clearly looking to hire more ‘feet on the ground’ in these fundamental roles.

The August trends demonstrate the increasingly regionalised impact of the COVID-19 restrictions – some regions still much more affected than others. Compared to August 2019, Regional SA had 18% more jobs advertised in August 2020, with Regional NSW also up on last year by 15% and Regional WA up by 11%. One the other side, Regional VIC, TAS and the Northern Territory were all still down on last year by 15 to 18% each.

There is a clear connection between managing COVID-19 and vacancy numbers, with Regional SA, WA and NSW having few cases of infection. Regional QLD and TAS have also managed the coronavirus well but have not seen the uptick in vacancies. This is likely due to the smaller internal economy in TAS, and in both states, the importance of interstate and international tourism to their services economies.

The closure of Australia’s international borders has cut the flow of overseas tourists, new long term residents and temporary workers. All three categories are having a significant impact on economic conditions in Regional Australia. Places used to seeing large numbers of international tourists like Cairns and the Gold Coast are seeing up to 40% of businesses relying on JobKeeper. In some of our smaller regional tourism hotspots like Eumundi in the Sunshine Coast Hinterland, Byron Bay NSW and Apollo Bay VIC, over 60% of businesses have been relying on JobKeeper, and these payments will be having a big positive impact on the money circulating in these hard-hit places.

There is a clear connection between managing COVID-19 and vacancy numbers, with Regional SA, WA and NSW having few cases of infection.

There are signs that regional tourism is picking up in some places. WA looks like a litmus test for post-restriction domestic tourism as its internal borders have been open for some months, case numbers are low and there is clearly a mood to travel. The Southwest WA tourism region is a seeing its busiest spring ever, with forward bookings already at a high level through to early 2021. There are signs that long-distance drive holidays are picking up in QLD too, bringing a different clientele to regional and even some remote destinations.

Inland visitation in NSW and VIC though is still at a low level and many regions are getting active in promoting themselves as destinations and alternatives to cancelled overseas holidays.

There is a chance that domestic travel could fill the gap left by international inbound visitors in Regional Australia. Tourism Research Australia points out that in 2019 Australia had 9 million inbound international travellers spending around $30 billion. But this spend is concentrated in the capital cities and a handful of regional destinations like Tropical North QLD, the Whitsundays and Uluru. Few international visitors spend much time or money in other parts of Regional Australia. In contrast, domestic tourism is a much bigger market – over $105 billion in 2019. And with around 5 million outbound trips by Australians last year spending around $30 billion overseas, and perhaps a greater propensity for those with cancelled overseas holidays to spend time exploring Regional Australia, there is some chance that the next six months might not be as bad as predicted for the domestic tourism industry.

While there are signs that some regional labour markets are picking up, place-based and tailored policy responses are needed to address the dramatic differences in economic circumstances currently affecting Regional Australia.

Download the Regional Jobs Update by Chief Economist, September 2020