REGIONAL LABOUR MARKET – HEADLINE INDICATORS

Policy makers and stakeholders will be gathering in Canberra in September for the National Jobs and Skills Summit, as skills shortages continue to bite across the country. Regional Australia’s labour markets are caught up in this situation, reflected by the suite of indicators, a number of which we touch on in this note.

While this National Summit will focus on structural issues (and the policy responses), labour markets – employers in particular – are also facing significant cyclical changes, if not headwinds. Employers have been navigating through rising material input costs for some time now and there is some evidence that wages costs are also rising. Many cost pressures are likely to be more acute in regions than in metro areas. Add to that increased borrowing costs (in the wake of the RBA’s hikes to the official cash rate), and the labour market could be approaching a turning point.

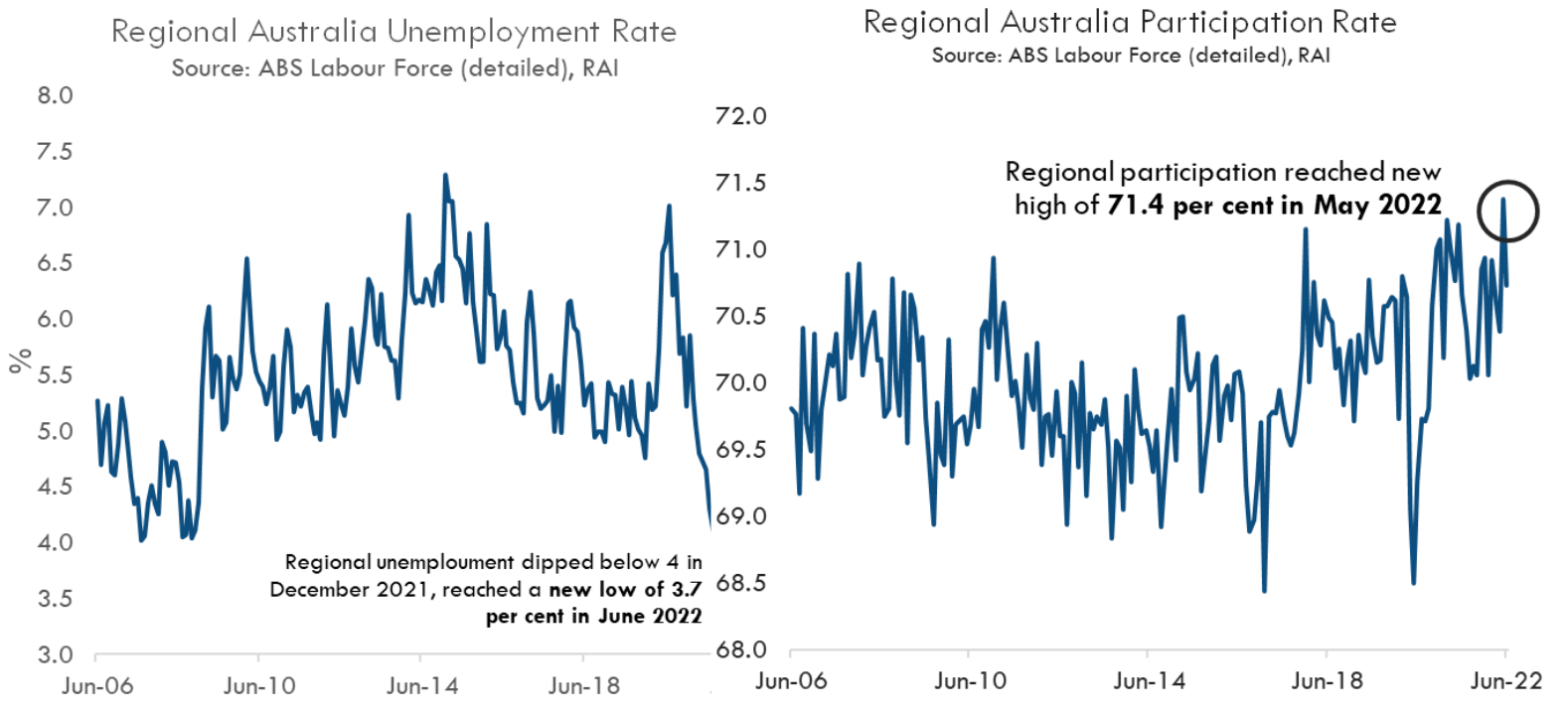

In terms of the unemployment rate, latest ABS data show that across regional Australia it fell to a new low in June, down to just 3.7 per cent. Underneath this aggregate rate is a lot of regional variation – which we outline further below.

Along with the very low unemployment rate across regional Australia, participation is very high – regional workers are seeing the favourable conditions and are engaged and keen to work.

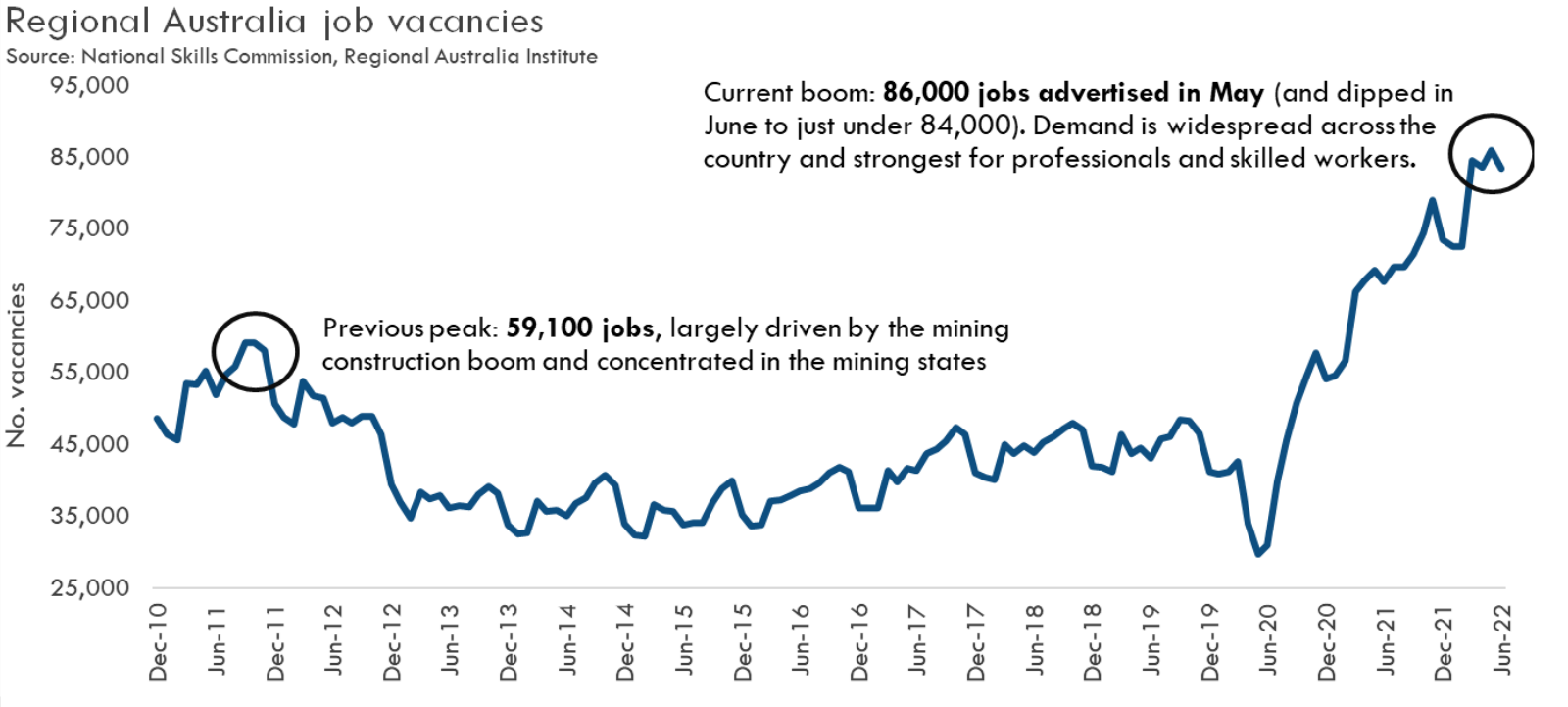

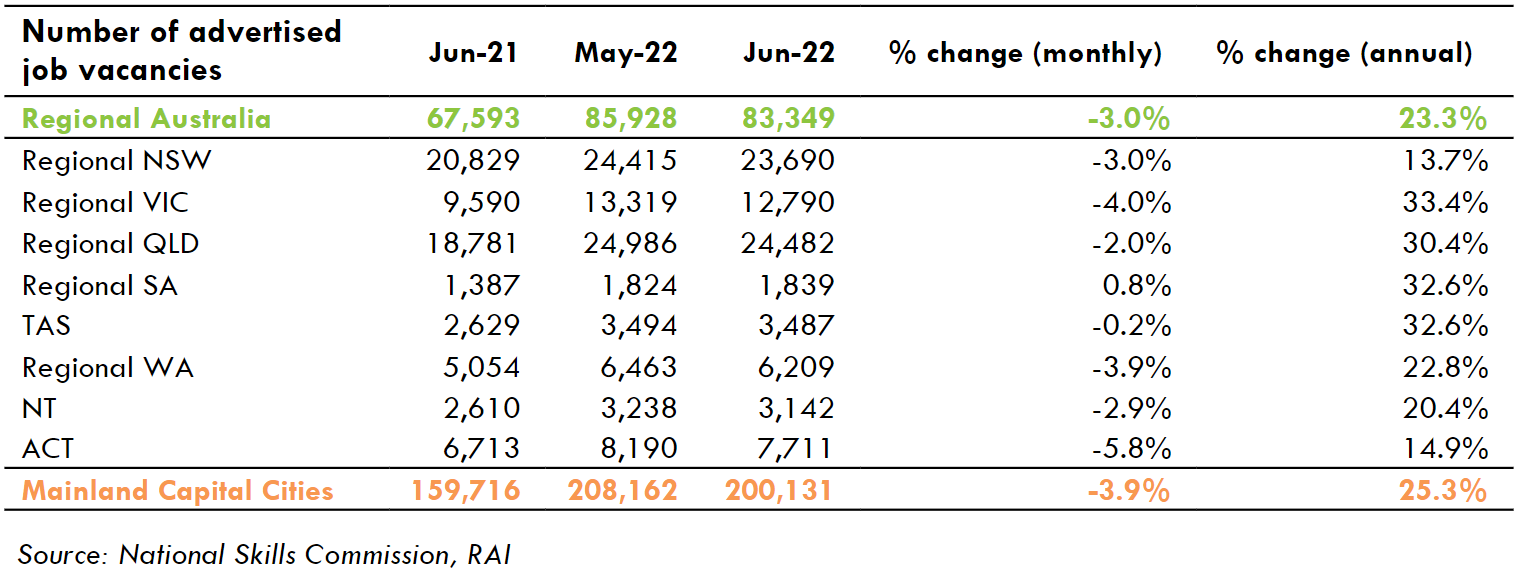

These headline indicators also represent very tight conditions for employers, who face a diminishing pool of available labour to fill ever-increasing job vacancies. While regional online job ads dipped by 3.0 per cent to reach 83,300 in June, this follows a fresh record set in May. Demand for labour in regions is still very strong; 23.3 per cent higher than a year earlier.

Moreover, recruitment difficulty in regions remains high – data from the National Skills Commission shows that 67 per cent of regional employers reported difficulties recruiting in June this year – a share that is materially larger than in 2021, when an average of 57 per cent of regional employers were experiencing recruitment difficulty through the year.

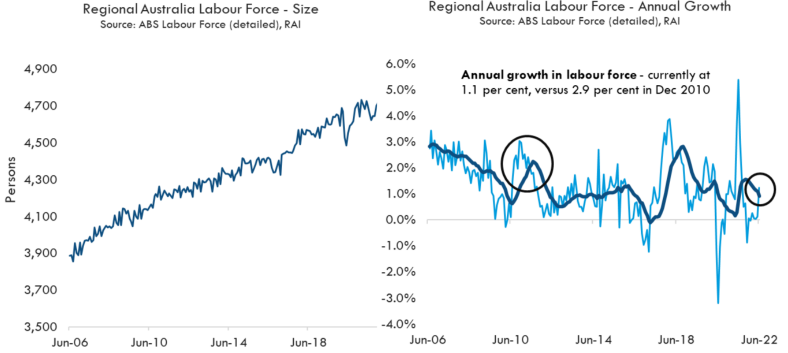

As we’ve pointed out before, current demand for labour is far exceeding the demand associated with the mining construction boom back in 2010-2012.

In the face of this demand, the supply of labour (the overall size of the labour force – those people either working or actively looking for work) is continuing to grow as shown in the chart on the left. However, it is not growing quickly enough. The chart on the right shows that the regional labour force grew very rapidly in response to the mining boom. This time round, despite demand that is far in excess of those mining boom times, the growth in the size of labour force has been relatively slow.

REGIONAL JOB VACANCIES…

In line with the headline decline, most regions recorded reduced job ads in June. Four regions outperformed the national decline. These growth spots are scattered around South Australia, Tasmania, and New South Wales.

Latest advertised vacancies are well in excess of what was being advertised a year earlier in all regions but one. The annual growth in vacancies in the various regions are in the double digits, ranging from around 10 per cent to 40 per cent. The only region where there were fewer vacancies in June 2022 than June 2021 is Dubbo and Western NSW (down by 17.7 per cent).

The four regions recording monthly increases in vacancies from May to June 2022 were:

- Port Augusta & Eyre Peninsula with 1.8% more vacancies in June 2022 (652) than in May 2022 (641)

- Fleurieu Peninsula & Murray Mallee up by 1.0% (932 compared to 923)

- Hobart & Southeast Tasmania edging up by 0.7% (2,016 compared to 2,002)

- NSW North Coast edging up by 0.5% (4,136 compared to 4,117)

The five regions with the biggest jumps in vacancies in June 2022 compared with June 2021 were:

- Geelong & Surf Coast up by 41.9%

- Outback Queensland up by 41.8%

- Hobart & Southeast Tasmania up by 38.7%

- Gippsland up by 37.6%

- Central Queensland up by 37.4%

In terms of the occupations being demanded, vacancies are largest for professional roles (24%) of all vacancies in June, followed by Technicians and Trades roles (16%), and Clerical and Administrative roles (14 %).

…PAIRED WITH REGIONAL UNEMPLOYMENT SHOWS VARYING DYNAMICS IN DIFFERENT REGIONS

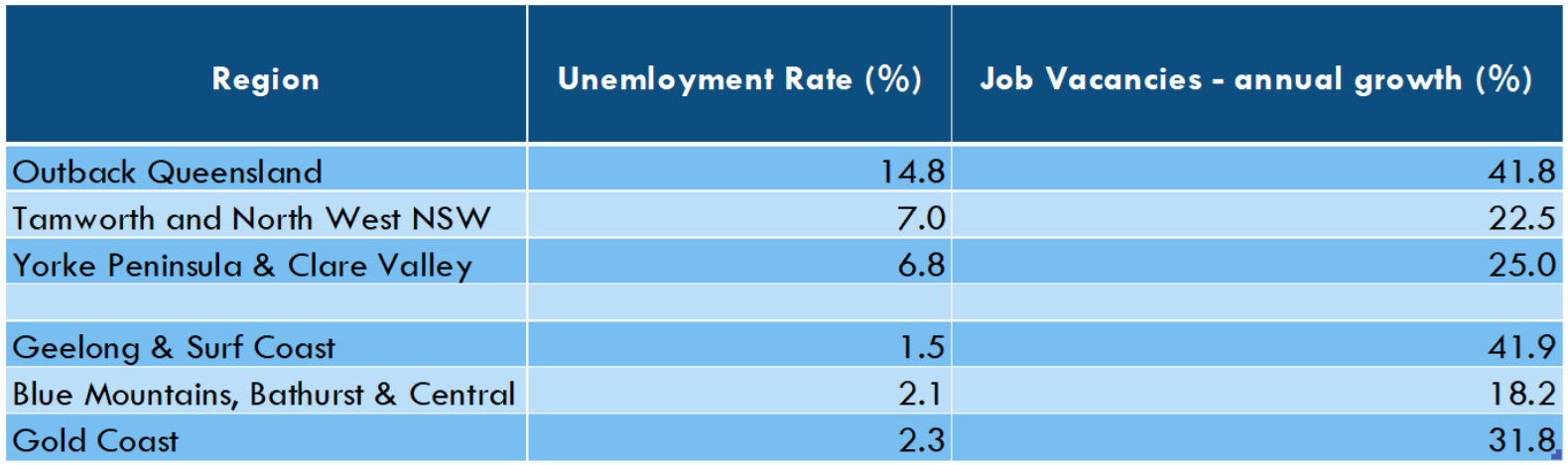

While demand for labour is high across just about every single region, there is significant variation in unemployment rates. Regions are splitting into those with stubbornly high unemployment and those where unemployment is exceptionally low. Policy and program responses need to be tailored to suit these very different circumstances.

Geelong & Surf Coast and Outback Queensland are two regions that together exemplify this divergence. Both regions are among the top five for annual growth in job vacancies. Geelong & Surf Coast has regional Australia’s lowest unemployment rate, while Outback Queensland has had a persistently high unemployment rate, currently the highest.

In the Geelong & Surf Coast region, unemployment is virtually non-existent (1.5 pe cent). In places like this, shortages of workers (and probably accommodation for workers) will be the main constraints. Policy and program responses need to encourage and enable more people to relocate into these regions. Policymakers can be considering the role of secondary migration patterns in relation to Australia’s overall skilled migration program to assist plug these gaps.

In Outback Queensland, the high unemployment rate (14.8 per cent) shows that there is still a sizeable pool of local people seeking work but their skills and interests are not well matched to the large (and still-growing) number of jobs available. In places like this there are significant opportunities to better use the local labour force. Policies and programs need to improve jobseeker skills and work readiness and improve connections between jobseekers and employers.

Source: National Skills Commission, ABS Labour Force (detailed), RAI

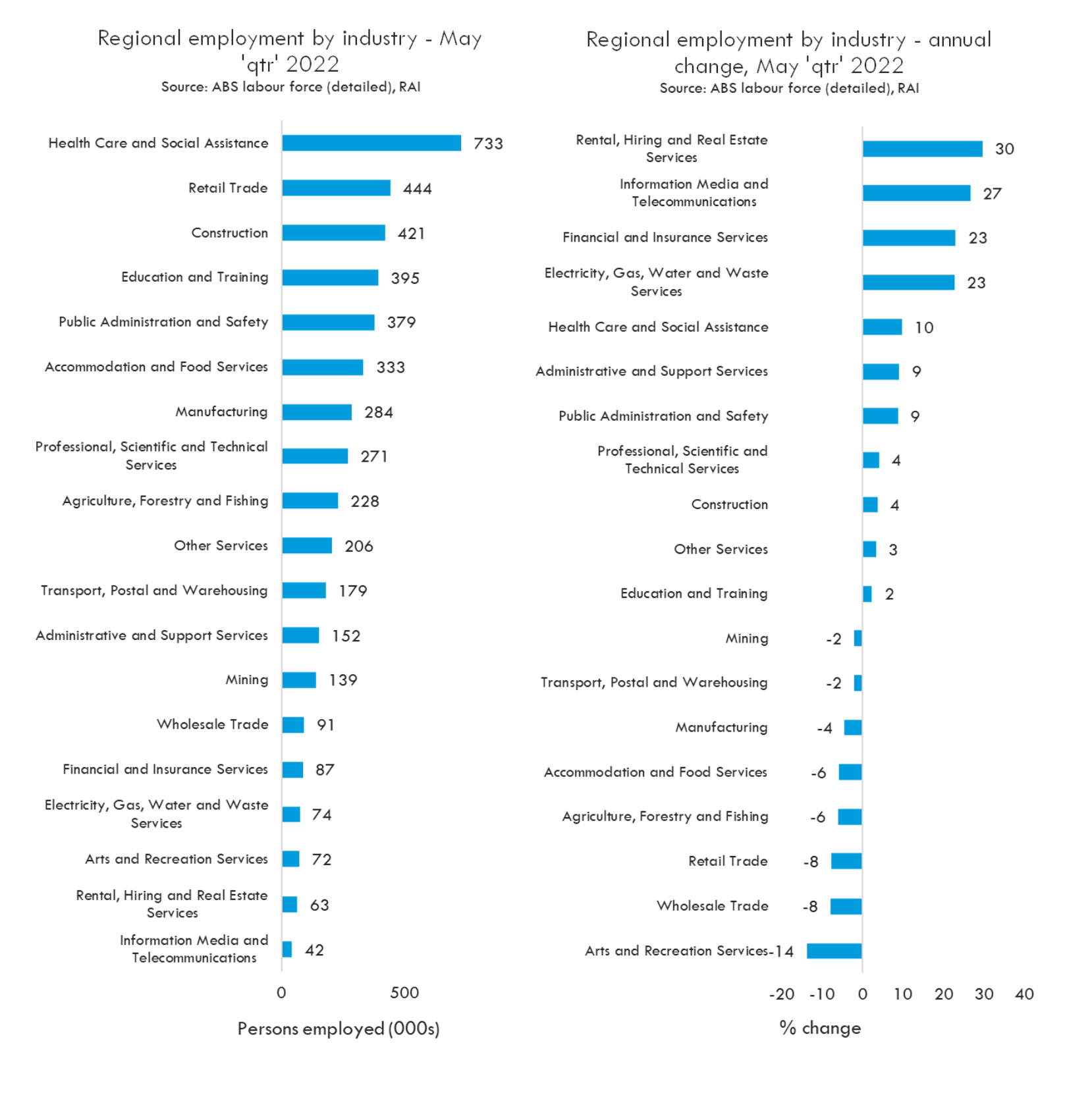

REGIONAL EMPLOYMENT BY INDUSTRY

The Health Care and Social Assistance sector is regional Australia’s largest employer, and demand here has grown; the number of people employed in this sector in the three months to May 2022 some 10 per cent more than a year earlier.

In the current environment of overall tight labour supply, falling employment in some sectors is likely to represent ‘crowding out’ by other sectors, rather than falling demand. Sectors like Accommodation and Retail Trade are significant employers in regions and the falling numbers of workers is likely representing a loss of workers to other sectors offering better pay and conditions.

Meanwhile the strong activity in regional housing markets – and the rising prices (both rental and purchase) – is the backdrop to the Rental, Hiring and Real Estate Services sector recording the highest growth in employment.